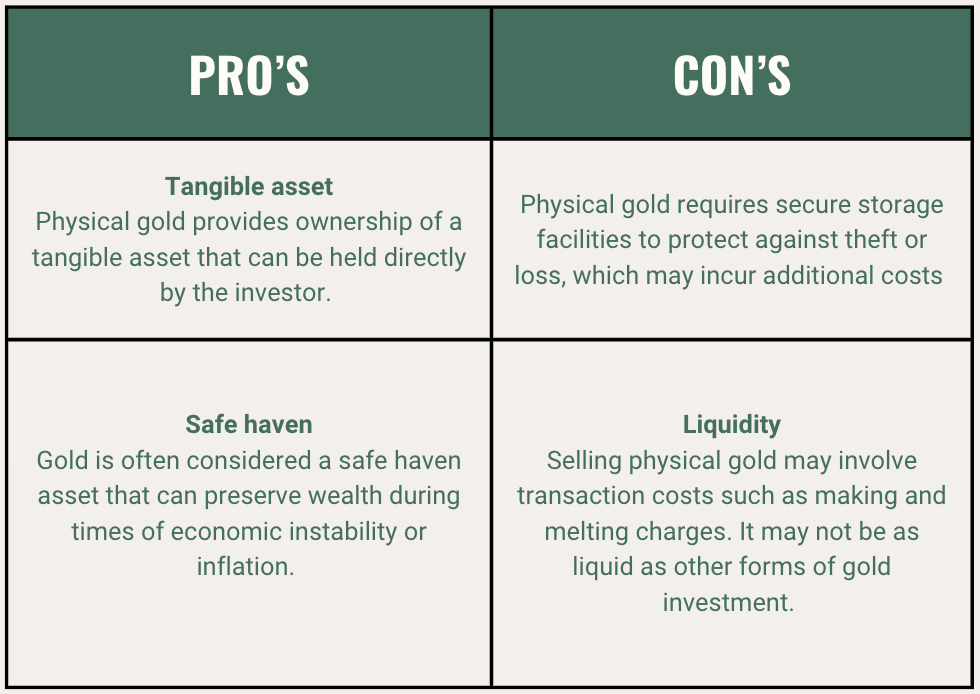

Buying physical gold in the form of bullion bars, coins, or jewelry is a common way to invest in gold.

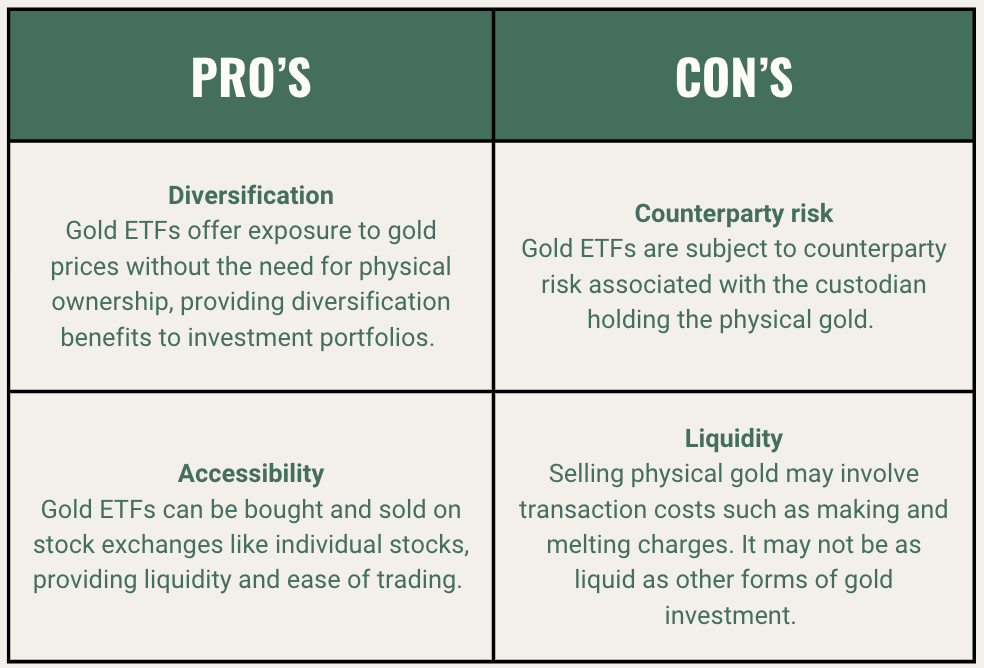

Gold ETFs are exchange-traded funds that invest in physical gold bullion and aim to track the price of gold.

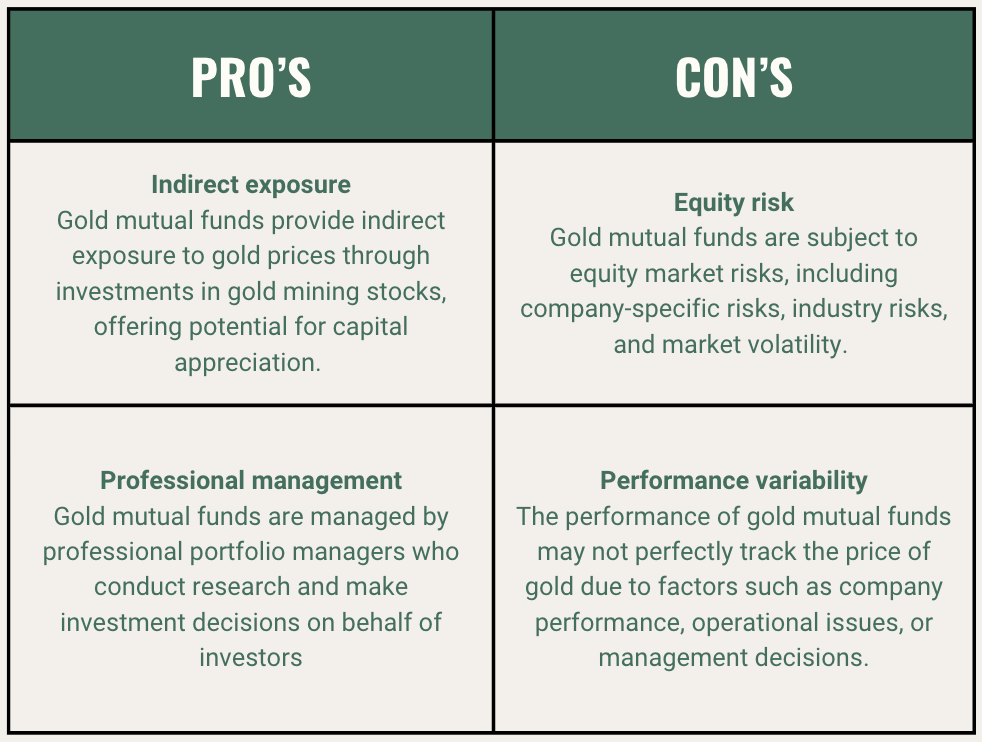

Gold mutual funds invest in shares of companies engaged in gold mining, exploration, or production.

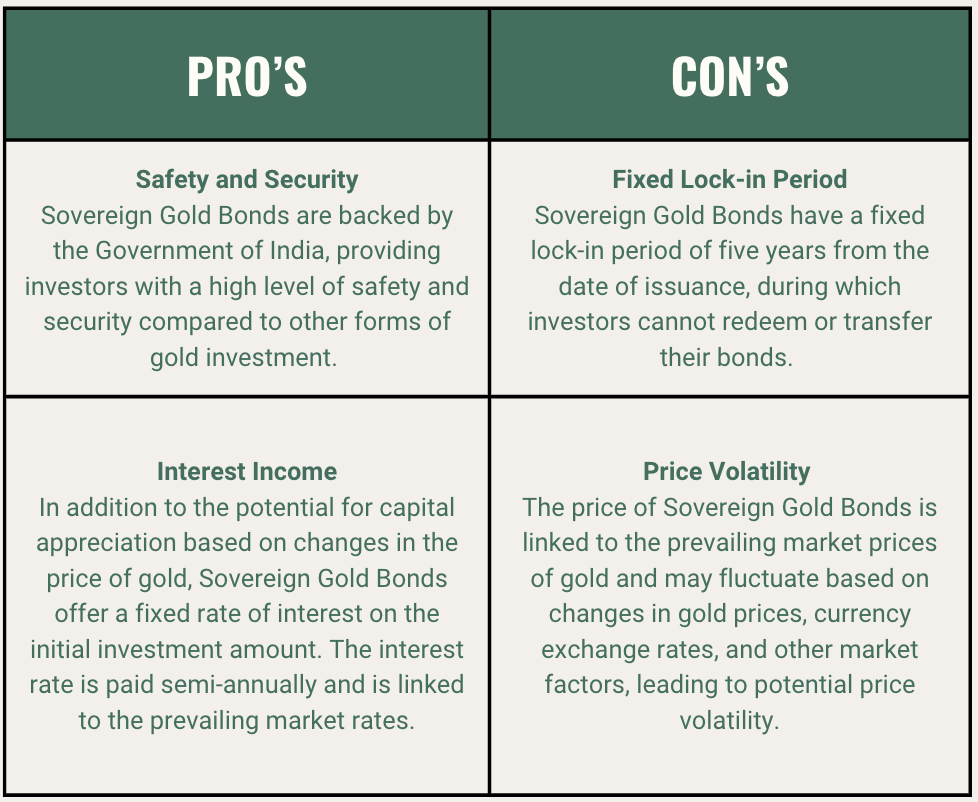

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These bonds have tenure of eight years and when held till the maturity date benefit the investors without having to pay any taxes. However, in case of emergency, these bonds can be sold on stock exchange to retrieve the investment but this move becomes open to taxes.