These funds aim to provide long-term capital appreciation by investing in companies with growth potential. Equity funds may focus on specific sectors, market capitalizations (large-cap, mid-cap, small-cap), investment styles (value, growth, blend), or geographic regions (domestic, international, global).

It invests in fixed-income securities such as government bonds, corporate bonds, municipal bonds, or mortgage-backed securities. These funds aim to generate income through interest payments and capital appreciation from changes in bond prices.

Money market funds invest in short-term, low-risk securities such as Treasury bills, certificates of deposit (CDs), commercial paper, and short-term bonds.

Balanced funds invest in a mix of stocks and bonds to achieve a balanced portfolio allocation. These funds aim to provide both capital appreciation and income while managing risk through diversification across asset classes.

Index funds seek to replicate the performance of a specific market index, such as the Nifty, by holding a portfolio of securities that mirrors the index's composition. These passively managed funds aim to match the returns of the benchmark index while minimising expenses and turnover.

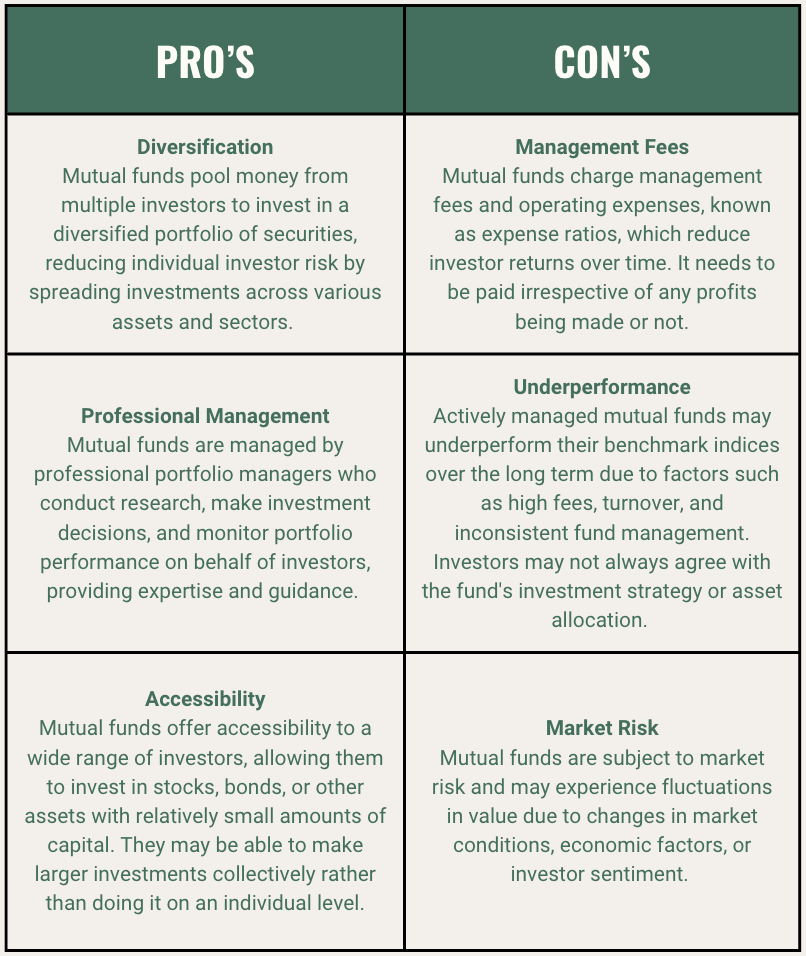

It all depends on the ability of the expert to be able to research and undertake investment for you.